Did you know?

Who We Are

WEALTH (WCPD Inc.) is a boutique financial services firm specializing in tax reduction, philanthropy and financing for junior mining and critical mineral exploration in Canada. WCPD Inc is an acronym – Wealth, Creation, Preservation & Donation. And as the name implies, we create wealth, we preserve wealth, and for our generous clients, we help them donate wealth to charities that touch their hearts.

With offices and representatives all across Canada, WEALTH is not only the originator of the structured flow-through share model, but also the leader in the number of deals closed.

Our highly personalized boutique services offer unique, safe and innovative financial solutions while working in tandem with larger financial institutions and other industry partners. Through the years, our firm has earned a reputation for superior customer service and a personal touch.

Lower Taxes, Higher Giving™. Are you ready for the next level? Our first meeting is always complementary with absolutely no obligation.

The Originator of Flow-Through Donation Financing

Amount of charitable giving facilitated by the WCPD Foundation:

Personal tax return filings since 2006, using a flow-through tax receipt and a charity tax receipt

Financing

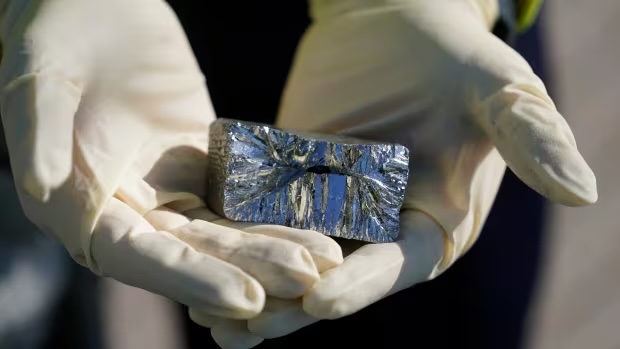

WEALTH (WCPD Inc.) is a leading exempt market dealer offering efficient financing for resource and critical mineral exploration in Canada