Triple your gift, triple your impact… at no additional cost.

What We Do

Philanthropic Tax Planning:

First and foremost, giving back comes from the heart. Many philanthropists do not always consider tax savings when it comes to their donations. The Foundation seeks to change that.

Our clients are among the most successful and generous people in society. Most want to know – what is the best and most efficient way to give? The answer to that question is through public flow-through shares with a liquidity provider. Using our proven and efficient flow-through share model, The Foundation can typically triple donations, and triple your impact, at no additional cost. We have facilitated significantly more flow-through transactions than any firm in Canada and assisted in north of $150 million in donations to charities across the country.

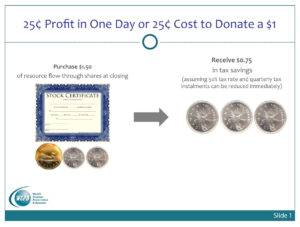

Since 1954, Canada Revenue Agency (CRA) has offered a 100% tax deduction on flow-through shares, which are stock issued by junior mining (and oil/gas) companies in Canada to fund drilling and exploration. The government offers this tax incentive due to the mining industry’s important role in employment and economic development, along with the substantial tax revenue should the company make a discovery. According to a 2017 World Bank Report, mining is also essential to the future of renewable energy, through the much-needed supply of metals and raw materials.

To unlock the tax benefits, clients purchase these public flow-through shares and then immediately sell them at a discount to an institutional buyer, or liquidity provider, for cash. This liquidity provider takes on the stock market risk, not our donors – this is a key benefit. The donors give the cash proceeds of the sale to the charities of their choice and receive another 100% tax deduction for this donation.

By combining these two taxes policies, our clients can reduce their taxes while giving more to a cause that touches their hearts. The Foundation takes care of the entire process for you, from beginning to end.

Download our Coins Presentation

Proud to Support

The Foundation (WCPD) is proud to be an Imagine Canada Caring Company. As such, we invest a minimum of 1% of pre-tax profit to strengthen Canadian communities and contribute to a vibrant, healthy society.

WCPD Foundation

Some of The Foundation’s clients have their own private foundations to distribute funds. For the convenience of our clients, we also offer the public WCPD Foundation, a registered donor-advised foundation that efficiently disburses cash donations from the cash proceeds of the flow-through sale. Once the cash arrives in the WCPD Foundation, there is no fee or deadline to allocate your charitable donations.

Clients can even assign his or her foundation a unique name, such as the Johnson Family Foundation, for example, which would then rest under the umbrella of the WCPD Foundation.

How it Works

Step 1

Buy flow-through shares issued by a Canadian mining company.

Every dollar invested in these shares is 100% tax deductible.

Step 2

Immediately sell these shares to a pre-arranged buyer (liquidity provider) at a pre-arranged contractual price for cash

This step eliminates any stock market risk to the donor.

Step 3

Donate the cash proceeds to your favourite charity.

Receive a charitable tax receipt based on the cash value..

The Result

By combining two tax policies (flow-through shares & donations), the Foundation (WCPD) can help reduce your taxes and allow you to give more.

*Use the cash proceeds to fund a life insurance policy to give up to two-to-five times more, depending on your age. Learn more here.

Coins Presentation

By The Numbers

Advanced CRA tax rulings on this exact structure, with flow-through shares

The year CRA introduced flow-through shares as a 100% tax deduction – three years older than RRSPs

Number of personal tax return filings since 2006, using a flow-through tax receipt and a charity tax receipt

Amount of charitable giving facilitated by the Foundation (WCPD)

Number of cheques issued by the Foundation (WCPD) to other charities, as directed by clients

Years the Foundation (WCPD) has specialized in philanthropic tax planning