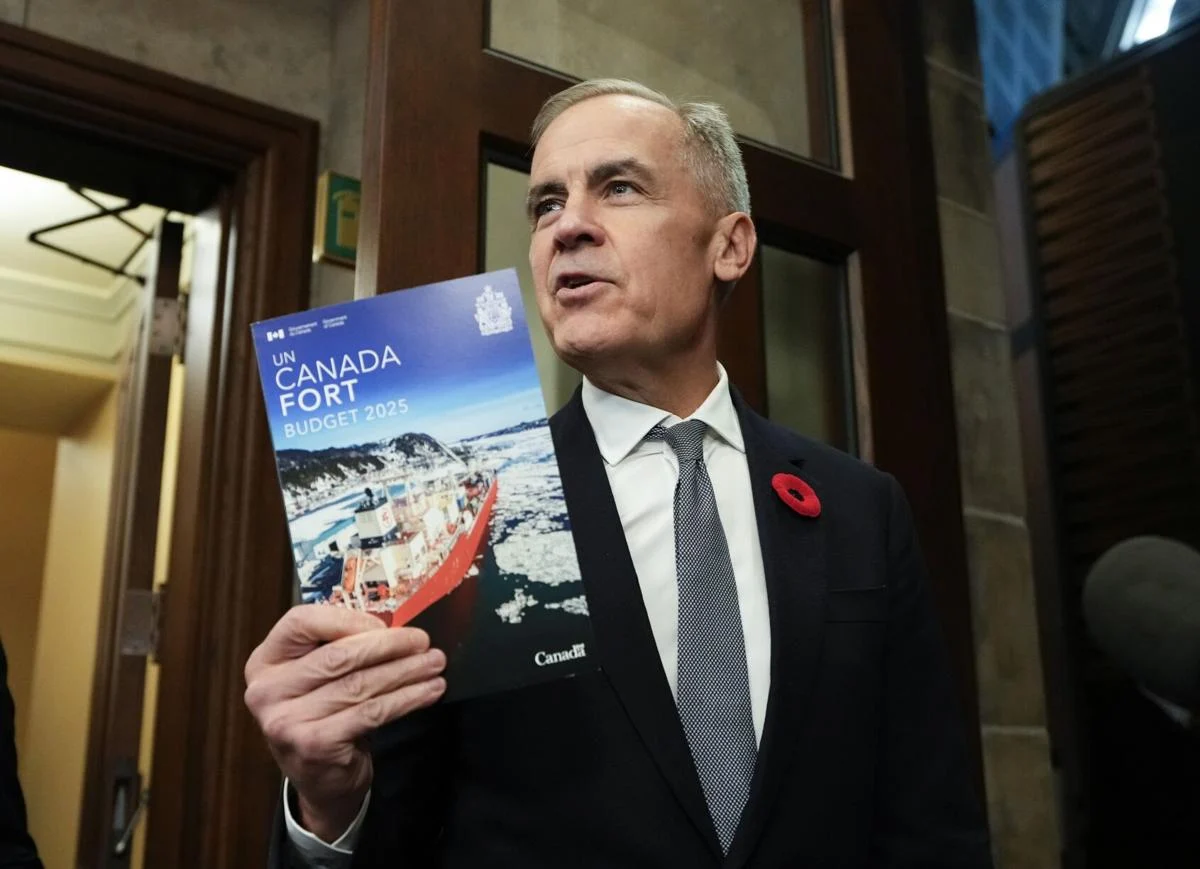

As expected, the latest Federal Budget highlights the government’s strong support for Structured Flow-Through Shares and its role in Canada’s critical mineral industry.

Here are a few highlights from this “historic” Federal Budget for exploration and critical minerals:

- Renewal of the Mineral Exploration Tax Credit (METC) confirmed as expected until March 30th, 2027, to align with the Critical Mineral Exploration Credit (CMETC). We do expect at least the CMETC 30% tax credit to be extended beyond 2027.

- Expansion of the Critical Mineral Exploration Tax Credit (CMETC) to include an additional 12 minerals necessary for defense and technology.

- Announcement of a $2 billion federal funding for a Canadian Critical Minerals Sovereign Fund (over five years) to make strategic investments

- Since there was no improvement to Alternative Minimum Tax (AMT), it’s business as usual, with 2026 and beyond looking positive for Structured Flows.

Also of note: the Federal Budget did not mention the expansion of the Flow-Through model to early-stage technology companies. Nevertheless, we remain optimistic it is still being considered for the future.

To access the 2025 Federal Budget, click here.

What does that mean to you?

Now that we have positively cleared Finance’s Federal Budget for the 19th year in a row, it is time to make sure you purchase your 2025 personal and corporate Flow-Through allocation, if you have not already done so.

Please reply now to meet with our team and ensure you receive the maximum benefit.

Why act now?

So far, the stock market has not severely corrected, as some expect it will before year end. Our firm continues to offer an unusually large supply of well-priced Structured Flow-Through Shares for high-taxed individuals (income over $225K) and their corporations.

However, a severe market correction before year end could impact our liquidity providers, reducing access to product and increasing pricing for you.

Next Steps:

Simply email us here to learning more and what fits for you.

Our tax team specializes in providing a 2025 income analysis to optimize the appropriate Flow-Through amounts for you personally and for any corporations that pay high tax rates. Flow-Through deductions can be carried forward indefinitely, and, in certain cases, Flow-Through tax credits can be carried back up to three years (2022-2024) to generate refunds.

Bottom line: Now is your chance to receive your maximum benefit through Structured Flow-Through Shares.

Do you know someone who is new to Structured Flow-Through, but might benefit from this structure?

Please feel free to forward this email. We are gratefully accepting referrals.

Thank you for your business.

Sincerely,

Peter Nicholson & The WCPD Team